by | IR Dr. Abdul Rahim Abu Talib & Nur Farhana Helme

The aerospace industry in Malaysia has grown rapidly since the introduction of the fist National Aerospace Blueprint in 1997. However, there is still considerable room for further growth as, despite the fact that the industry has seen rapid growth; most of the activities that Malaysia’s aerospace industries are involved with are in the maintenance, repair and overhaul industry along with build to specification manufacturing.

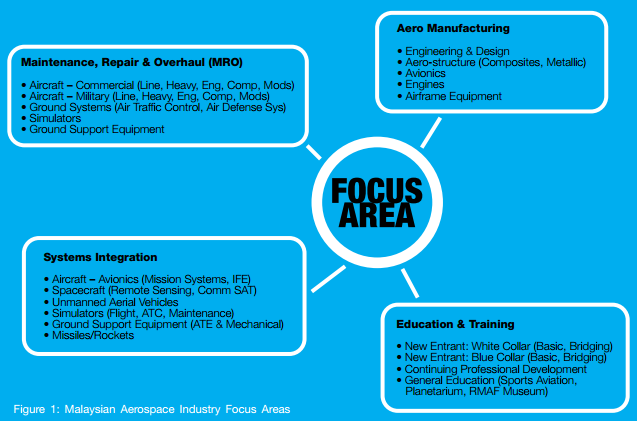

These activities do not facilitate the transfer of technology and are mostly labour intensive. In Malaysian context, the definition of the Aerospace industry covers activities that relates to design, development, manufacturing, construction, maintenance and disposal of aircraft, spacecraft, missiles and rockets. It includes enablers to the above activities such as regulatory of civil and military aviation, talent development education and training, and infrastructures such as airports, fi based operators (FBO) and technology parks. It excludes the “operation” of aircraft, spacecraft, and missile and rockets (i.e commercial, general and military aviation). Further breakdown of Malaysia’s aerospace industry, based on the four focus areas defied in 2001 by the Malaysian Aerospace Council (MAC), is shown in Figure 1

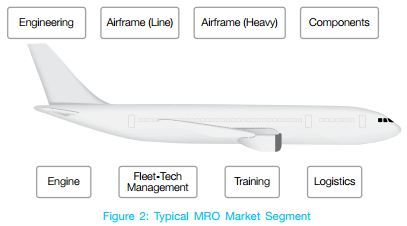

Regional industry dynamics has enabled the aerospace industry in Malaysia to grow and contribute to the nation’s high income economy. In the most recent year (2014) the industry had a turnover of RM11.8 billion, and there are 159 companies employing 19,500 workforce. There have also been substantial investments from both domestic and foreign investors. The total investment in 2013 was recorded at RM387 million and the export value for the year was RM2.4 billion. Currently, the largest aerospace industry (outside of aviation) is the MRO sub-sector. This sector accounts for 55% of the industry. This is followed by the aerospace manufacturing sub-sector, which has 33% of the industry. In general, the MRO ecosystem consists of eight (8) end-to-end services as shown below.

The aerospace market is changing rapidly, especially in Asia. This industry is growing very rapidly with Asia leading the growth. More commercial aircraft are being produced annually today than at any time in history. Recently, Boeing announced plans to produce 900 new airliners per year, and Airbus is producing aircraft at the same or faster pace. A large number of these new airliners are to fill orders from Asian countries. This creates many opportunities for growth for the Malaysia’s Aerospace Industry. In order to take advantage of this growth, the Malaysia’s Aerospace Industry players must look at the areas in which this growth will occur, and examine the capabilities to support this growth.

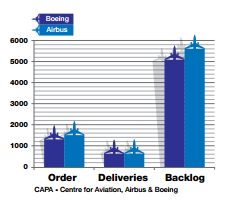

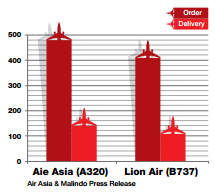

The growing world air traffic, large aircraft orders by airlines and backlog faced by the Primes (OEM aircraft manufacturers, in particular Boeing and Airbus) indicate the industry’s long term growth potential and strength. Narrow body operation will generate a vibrant MRO industry in the South East Asia (SEA) region. Order backlog is expected to increase off-loading of aero-structure manufacturing activity into the region (Figure 3a and 3b).

Figure 3: (A) Order, deliveries & backlog for Boeing and Airbus in 2014

Figure 3: (B) Order & delivery for Air Asia and Lion Air in 2014

To keep abreast with, and to take advantage of, the global growth of the aerospace industry, Malaysia needs to look into the preparation of human capitals – the current Aerospace Education and Training; and the shortcomings or gaps in supporting growth in these areas.

Aerospace Education & Training in Malaysia

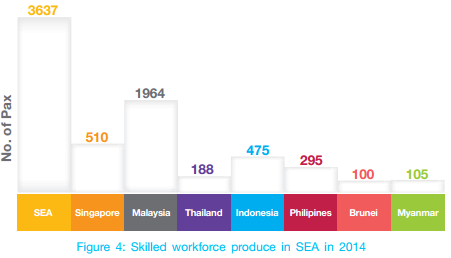

Currently, Malaysia does not only produce adequate graduates to support the needs of local industry, but is also able to export them to neighbouring countries. According to Boeing, there are more than 3,500 skilled workers available in South East Asia of which Malaysia produces more than 1,900, or 54% of all skilled workers for the region (Figure 4).

Every year, up to 300 graduate engineers and over 2,000 paraprofessionals are being produced locally. However, industry players reported that there is a need to align our current education and training programmes for both white and blue collars with the latest technology and industry trends, and that bridging programmes are needed to fast track employment. There is a shortage of para-professionals workers in the area of aero-manufacturing.

Workers from Malaysia are being successfully been employed all over the world. Many Malaysian trained MRO licensed technicians and engineers are currently employed in Singapore, UAE and elsewhere. Graduate aerospace engineers are being employed in Singapore, US, and Europe. Table 1 shows the current education and training providers for graduate engineers and paraprofessionals in Malaysia.

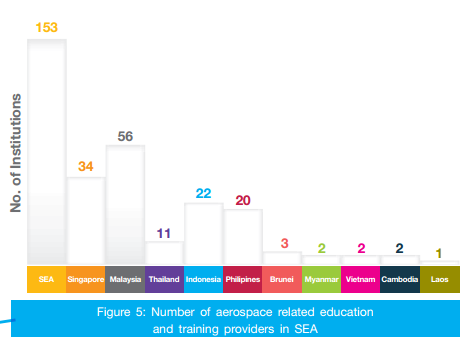

Currently, there are 66 education and training providers in aerospace related programmes in Malaysia comprising 11 DCA approved training organizations (ATO) which impart the training of licensed aircraft maintenance technicians and licensed aircraft maintenance engineers; 11 licensed fling schools for pilot training; 2 Cabin Crew Training Centres; 27 institutions of higher learning that offers bachelor of aerospace, aeronautical, avionics engineering programmes, and diplomas in aircraft maintenance technology, helicopter maintenance, avionics maintenance and composite repair; and 15 technical training academies. Figure 5 shows the total number of education and training providers in South East Asia.

The main focus is on human capital development where training and education plays a big role in developing the industry across the region. Boeing has projected that in the year 2032, the estimated demand for technicians (MRO) and pilots and in SEA will be of 50,300 and 48,100 respectively, from the projected annual growth of 5% rate for technician, graduates and cabin crew, and 7% for pilot.

Malaysia is the leading producer and provider of skilled workforce in the SEA region and is on the right track to remain so for the foreseeable future. It is projected that by the year 2030, Malaysia will be able to produce 50,751 technicians and 15,556 graduates, and 16,746 pilots. Figure 6 shows the current regional education and training providers in the aerospace field.

Capability of the Current Education and Training

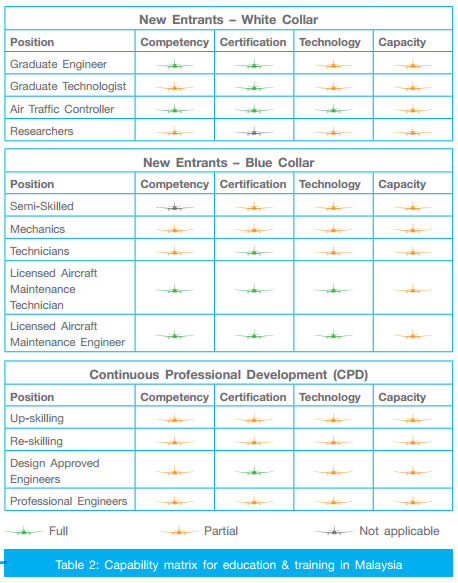

The capability in Education and Training is gauge through the analysis of the Capability Matrix – the workforce’s competency, certification, technology and capacity. MIGHT has been engaged with parties from the educational institutions and industry where massive data was collected to derive these capability matrixes for the position of white collars, blue collars, and Continuous Professional Development (CPD).

The competency of Malaysia’s training providers in teaching and binding the training needs for our local talents is very encouraging as the country has managed to produce quality graduate engineers, air traffic controllers (ATC), licensed aircraft maintenance technician (LAT) and licensed aircraft maintenance engineer (LAE). Our training providers has played an important role in supporting the industry growth, especially in MRO, by educating more trainers that would be licensed. These licensed trainers would be able to impart their knowledge to our local talents through special courses.

The certification by Malaysia’s training institutions is recognised internationally. This has made Malaysia the centre of aerospace education for South East Asia. To date, we have endorsed certification for graduate engineer, technologist, ATCs, technicians, LAT, LAE and Design Approved Engineers. Currently we are able to produce 380 trained and certified blue collar workers and 675 graduates annually. By 2030, Malaysia will be capable to produce talents to cater for the Asian market.

As a whole, Malaysia has medium capacity in terms of training and education. We are at best in technology proficiency for ATC, LAT and LAE. The machineries for training drill in the aerospace sector are furnished with latest gears best suited for our local skill development. However, we have not sustained the maximum growth of talents as required and projected by the OEMs. The full capability matrix for aerospace education and training in Malaysia as shown in Table 2.

Way Forward

Malaysia has been able to make the aerospace sector an important economic entity. In the year 2013, we were able to create 19,500 job opportunities in the sector. The vision is to create 32,000 job opportunities by the year 2030. Malaysia also aims to be the number one aerospace education and training hub in the South East Asia. To achieve these, the followings would have to be emphasized and implemented:

-

- Collaborative net and partnership between government agencies, institutions and private sectors in producing more quality talents. (Through merging of supply chain between suppliers and foreign companies. Training and education should be part of the business);

- Promote a conducive platform to gather experts from relevant sectors, mainly in Aero manufacturing and aviation to achieve the mission established by 2030. Recognize, retrieve, merge and transfer of knowledge among local experts and and train new talents. This will boost our chain of experts;

- Develop holistic training and education programmes that could sow the seed of aerospace career in a wider context;

- Enhance the effectiveness of institutions that have direct influence on the growth of the industry;

- Create opportunities for talents to encourage them to advance their skill and career while excite them in their pursuit of achieving high income;

- Embed positive strides on technological advancement through funds for innovative efforts in MRO and modification business;

- Increase number of design Engineers with signatory status for future design & build projects;

- Incur “apprenticeship programs” to fast track employment. The knowledge transfer from industry are best to be developed from early age of education; and

- Invest in R&T to develop new capabilities and enhance industry competitiveness.

Malaysia has the potential to become the hub of aerospace training and education if we strive to bridge the gaps and meet the needs of the industry. If the nation remains dedicated, we may definitely grow and contribute towards the future progression of the global aerospace arena.